Sustained private housing supply planned for 2H 2025 with several prime plots; total supply in 2025 highest since 2014

13 June 2025, Singapore - The government has raised the total private housing supply under the Government Land Sales (GLS) programme for the second half of 2025 (2H 2025) to cater to the healthy demand for private residential properties, including executive condominiums (EC). The newly announced GLS slate will offer 9,200 private homes (incl EC) across the Confirmed List and Reserve List - up by 8.2% from the total GLS supply of 8,505 units offered in 1H 2025. In all, the overall private housing supply for 2025 comes in at 17,705 units (incl EC) - the highest supply offered since 2014.

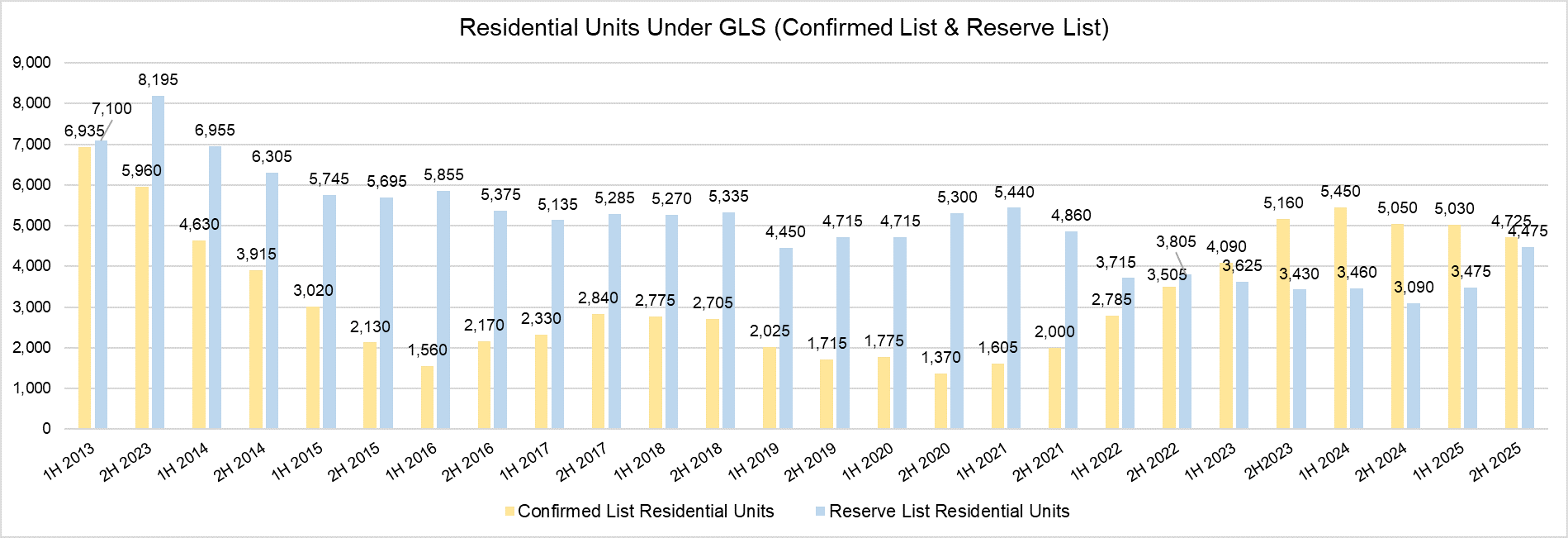

For the 2H 2025 GLS Confirmed List, it will offer 10 residential sites (including two EC plots) which can yield an estimated 4,725 residential units (including 990 EC units) - down slightly by 6.1% from the 5,030 units offered in the Confirmed List of the 1H 2025 GLS programme (see Chart 1). For the whole of 2025, there are 9,755 private residential units (incl. EC) offered under the Confirmed List.

Chart 1: Residential units offered under the GLS programme (CL and RL)

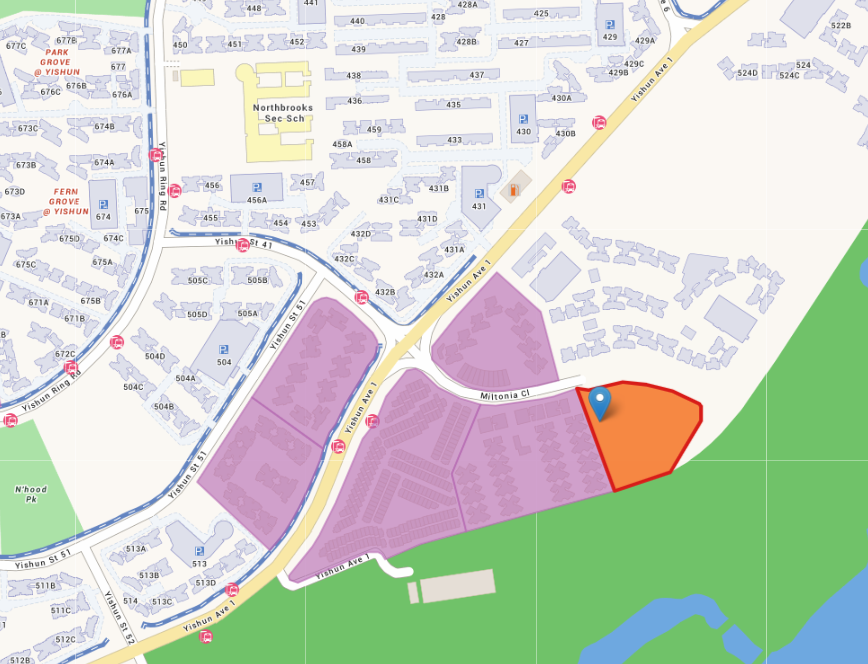

Of note, there were two new EC sites - in Woodlands Drive 17 and Miltonia Close - placed under the Confirmed List in 2H 2025, taking the total number of EC plots offered in the full year to five - more than the two EC sites that were typically offered annually in the last few years. The five Confirmed List EC sites for 2025 can collectively yield nearly 2,000 new EC units, which will be the highest since 2014.

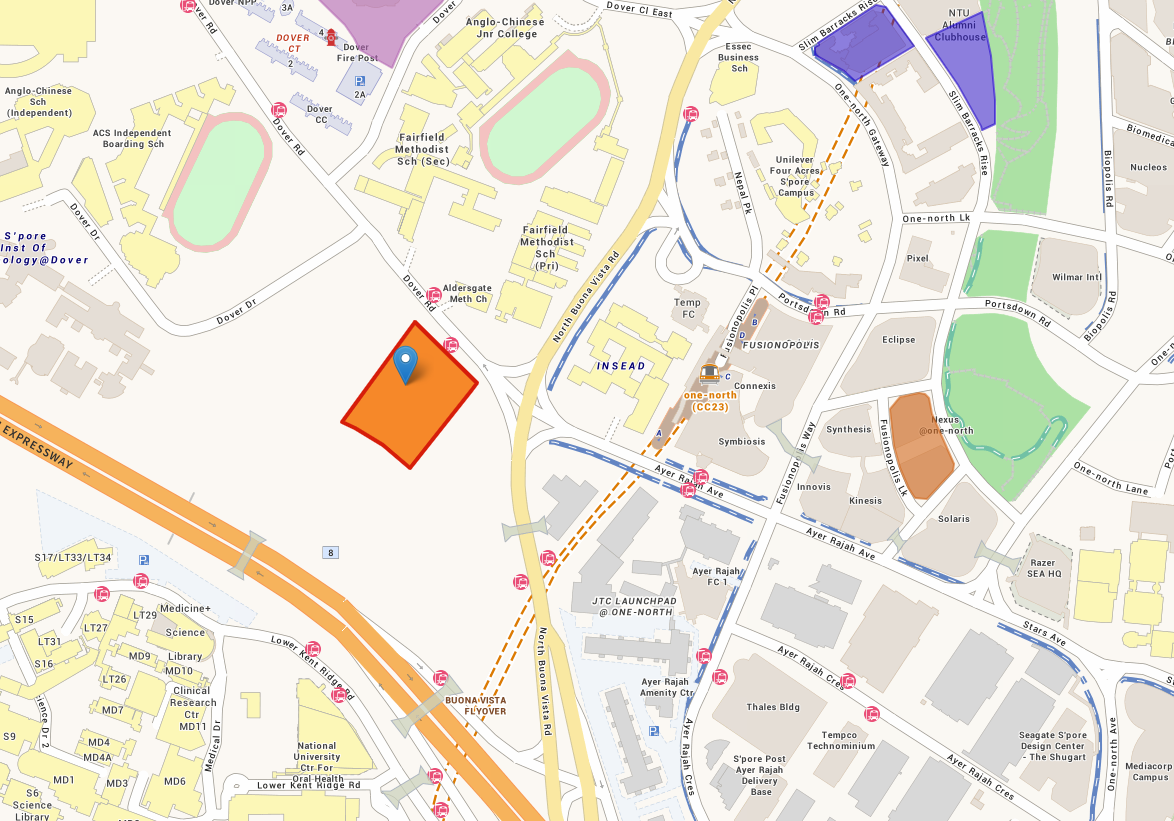

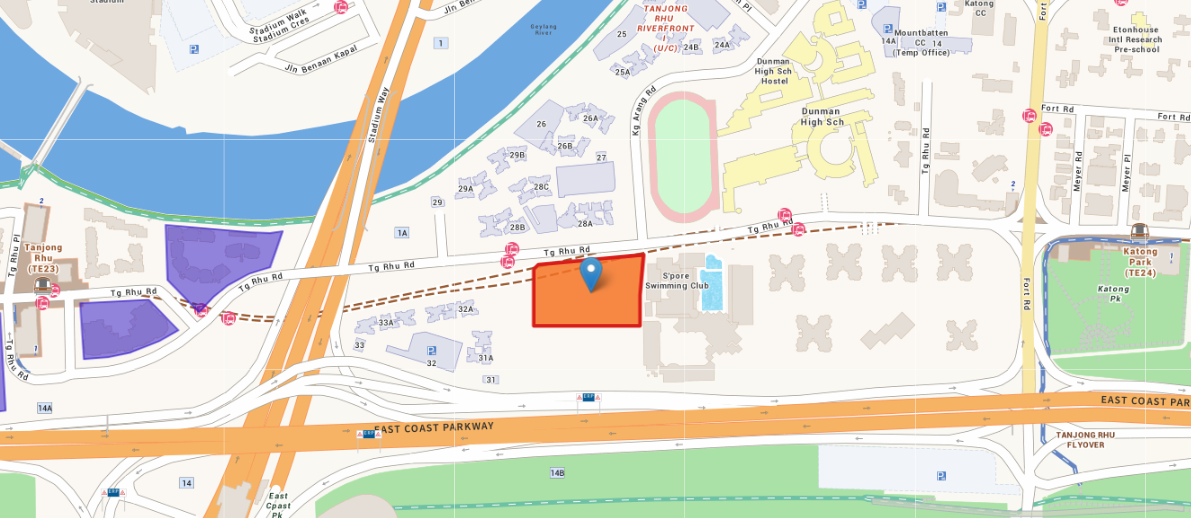

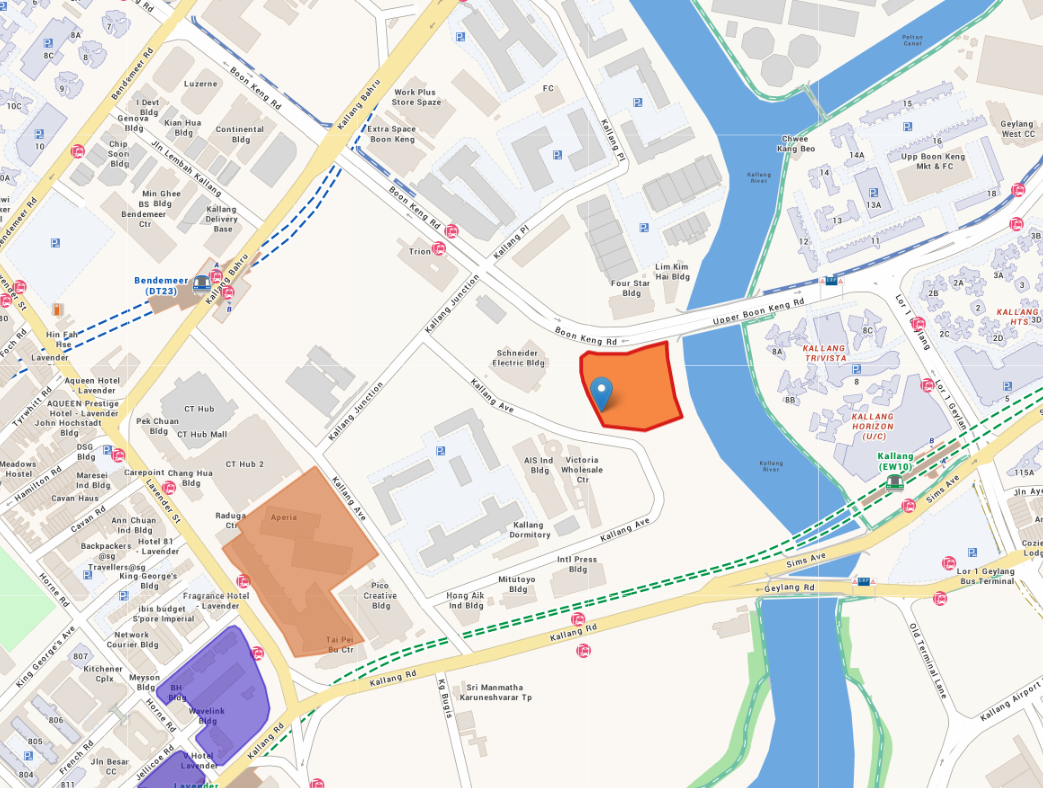

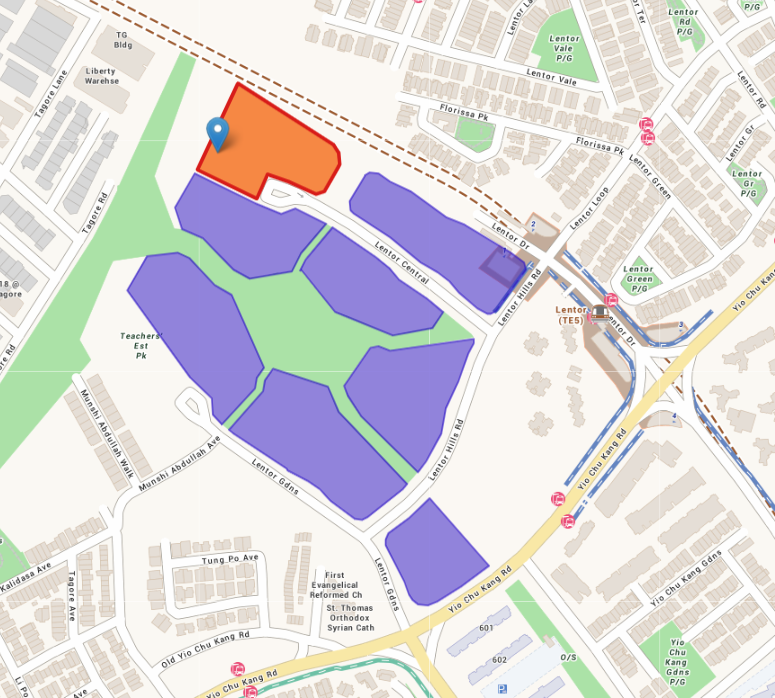

All 10 sites on the Confirmed List are newly-introduced to the GLS programme (see Annex). The other eight plots (ex. EC) are in Bukit Timah Road, Bedok Rise, Dairy Farm Walk, Dover Road, Tanjong Rhu, Dunearn Road, Kallang Avenue, and Lentor Central. The majority of the sites are located close to an existing MRT station.

Under the Reserve List for 2H 2025, the government has placed another 12 sites which can be triggered for sale by developers should there be market demand for them. The Reserve List comprises six residential plots, a commercial site, three white sites, and two hotel sites. They can collectively offer 4,475 residential units, 173,800 sq m gross floor area of commercial space, and 880 hotel rooms. New to the Reserve List are a residential site in Cross Street that is meant for long-stay serviced apartments only, and a hotel site in Telok Ayer Street where long-stay serviced apartments will be required. Meanwhile, the residential plot in Media Circle Parcel B - which saw no bids when its tender closed in April this year - has been placed on the Reserve List.

Mr Ismail Gafoor, CEO of PropNex said:

"On the whole, the 2H 2025 GLS slate is well-calibrated with a good geographical spread of site locations (see Annex for more details), including in upcoming housing precincts such as the Bukit Timah Turf City. We expect that many of the sites will generate keen interest among developers, who will be looking to replenish their land inventory with choice sites following robust primary market sales in Q4 2024 and Q1 2025, where new private home sales came in at 3,420 units and 3,375 units (ex. EC), respectively.

To this end, we observe that the participation in GLS land tenders has recovered slightly of late. For instance, the GLS tenders for residential, and residential with first-storey commercial plots that closed so far this year had pulled in an average of 3.6 bids, while those* that closed in 2024 had garnered 2.1 bids on average. Of note, the GLS site in Bayshore Road drew eight bids and was awarded for $1,388 psf ppr in March 2025 - a record GLS land rate for a residential site in the Outside Central Region (OCR). [*Exclude EC, white, and mixed-use sites]

With the easing of interest rates and improved buyer sentiment, as well as the relatively low unsold stock in the market, we believe many developers will look at the GLS 2H 2025 line-up with interest, especially well-located sites near to an MRT station and amenities. As at Q1 2025, the number of unsold uncompleted private homes (ex. EC) in the market stood at 18,125 units, which is the lowest in five quarters.

That said, we expect the ramp-up in private housing supply will cater to demand for homes and help to moderate home prices going forward. We note that developers' sales (ex. EC) in the last three years - at 6,469 units in 2024, 6,421 in 2023, and 7,099 in 2022 - have been measured, and that the total Confirmed List supply at 9,755 units (incl. EC) in 2025 is substantially higher than the 5-year average supply (2020-2024) of 6,558 units offered.

Specifically, we project that there are a few plots that could see stronger competition among developers. Among them, a residential site in Dover Road near to the one-north MRT station and has several schools within a 1-km radius, including Fairfield Methodist School (Primary and Secondary) across the site, Anglo-Chinese School (Independent), Anglo-Chinese Junior College, Singapore Polytechnic, National University of Singapore, INSEAD, Tanglin Trust School, and the United World College of South East Asia (Dover Campus).

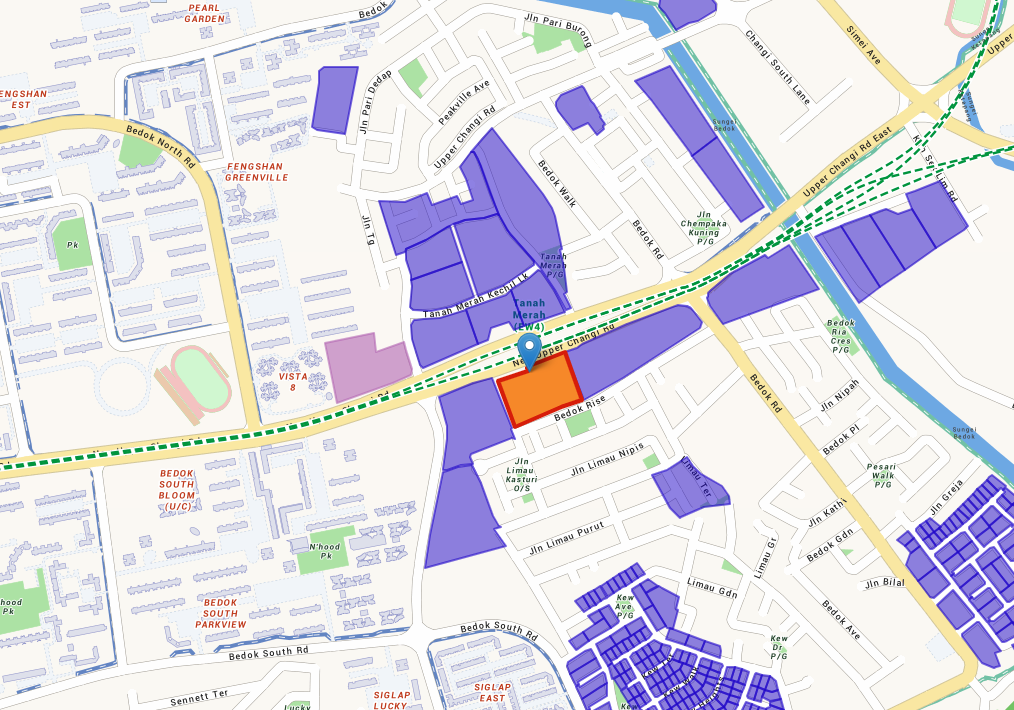

Meanwhile, a residential plot in Bedok Rise in front of the Tanah Merah MRT station could also be popular. This is the last plot of development site around the said train station, following the sale the Tanah Merah Kechil Link site (Sceneca Residence/Sceneca Square) in November 2020. Based on caveats lodged, Sceneca Residence has sold 264 out of its 268 units as at 31 May 2025, since the project hit the market in January 2023. We anticipate that demand for mass market homes, particularly those with strong public transport connectivity will remain sought-after.

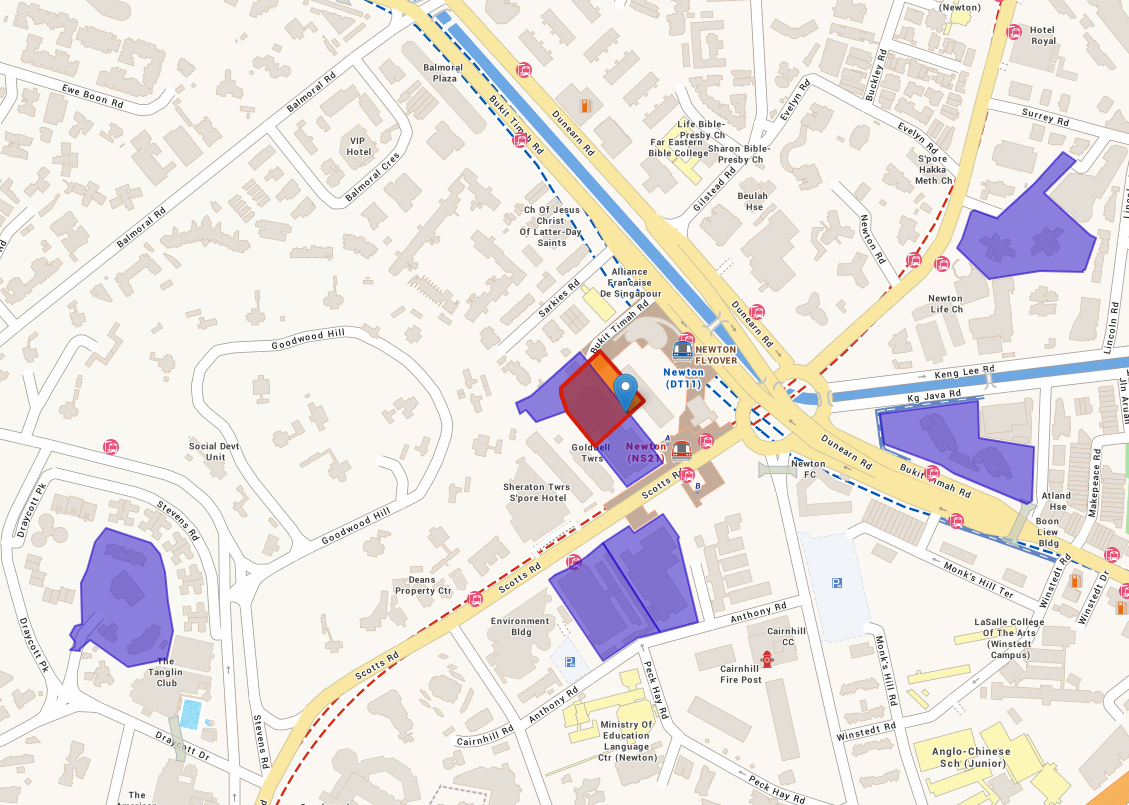

Another site that stood out is a residential plot next to the Newton MRT station in Bukit Timah Road, that is on the site of a former transitional office which was awarded on a 15-year lease in August 2007 to address the shortage in office space then. The last GLS plot awarded nearby was in Kampong Java Road where Kopar at Newton sits. According to URA Realis caveat data, the 378-unit Kopar at Newton has transacted 372 units after the project was launched in April 2020.

In view of the healthy demand for new EC units, the government has rolled out more EC GLS plots this year. As at the end of April 2025, there were only around 50 new unsold EC units on the market, with the latest launch Aurelle of Tampines EC selling out in a month. With more EC GLS sites offered in 2025, it should help to assuage the strong competition for EC plots among developers, and hopefully keep land bid prices from rising sharply. We will get a clearer picture of the EC land bid trend when the tenders for the three EC GLS sites - in Senja Close, Woodlands Drive 17, and Sembawang Road - that were launched in 1H 2025 close between August and September.

Given the ample supply of GLS sites lined up in 2H 2025, we anticipate that the private residential collective sale market may remain lukewarm. Developers tend to prefer the more straight-forward land acquisition approach under the GLS, and may likely dip into the en bloc sale market if there are well-located and realistically-priced developments up for sale, especially those that have a freehold land tenure."

Brief summary of New Confirmed List sites 2H 2025

Confirmed List Site | Remarks |

Bukit Timah Road - 340 units | *New Site

|

Bedok Rise - 380 units | *New Site

|

Woodlands Drive 17 EC - 560 units | *New Site

|

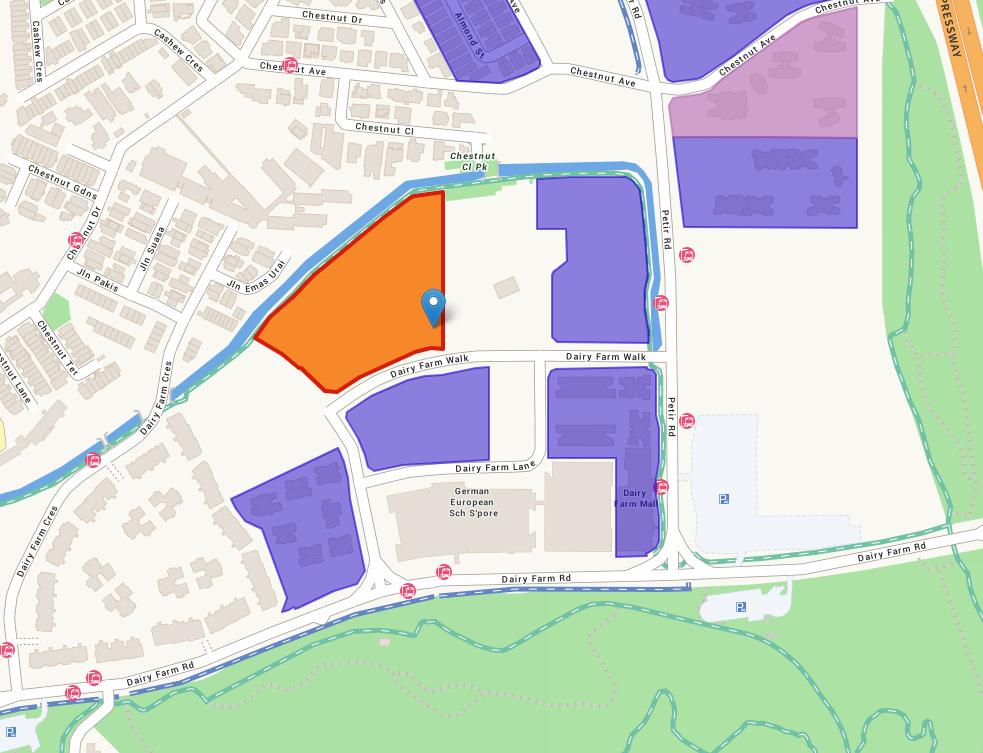

Dairy Farm Walk - 500 units | *New Site

|

Dover Road - 625 units | *New Site

|

Tanjong Rhu Road - 525 units | *New Site

|

Dunearn Road - 335 units | *New Site

|

Kallang Avenue - 450 units | *New Site

|

Lentor Central - 580 units | *New Site

|

Miltonia Close (EC) - 430 units | *New Site

|

Source: PropNex Research, URA Space

Brief summary of New Reserved List sites 2H 2025

Reserved List Site | Remarks |

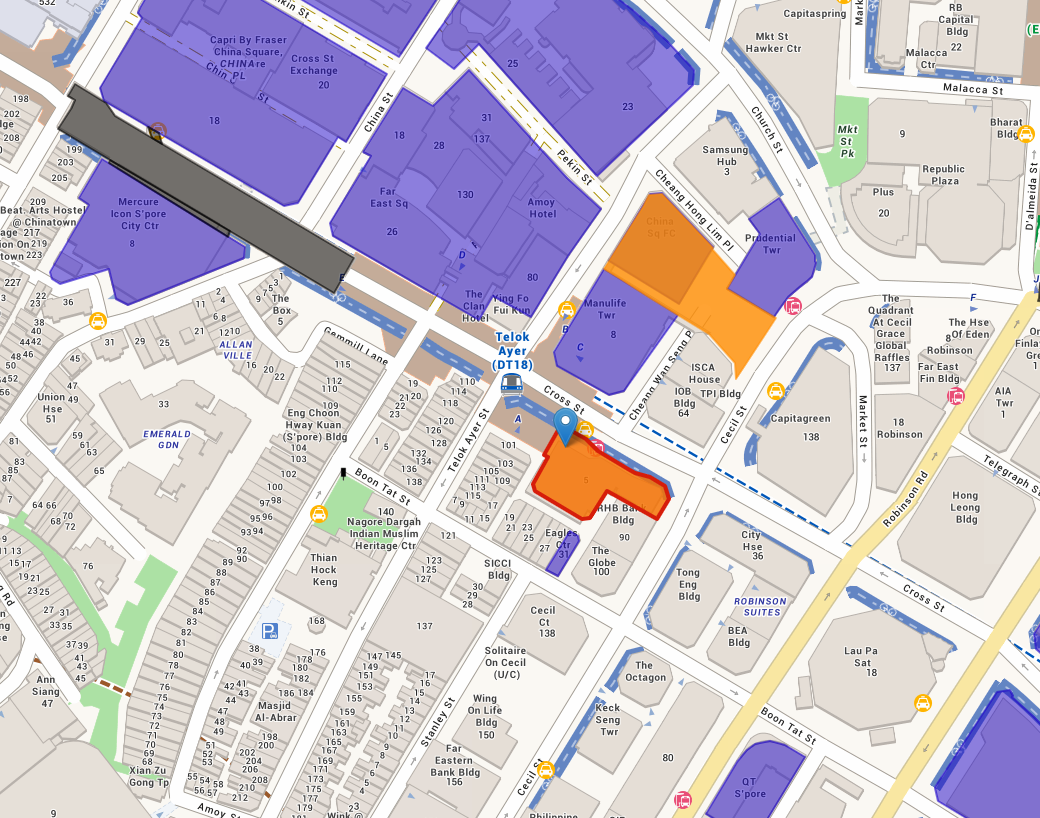

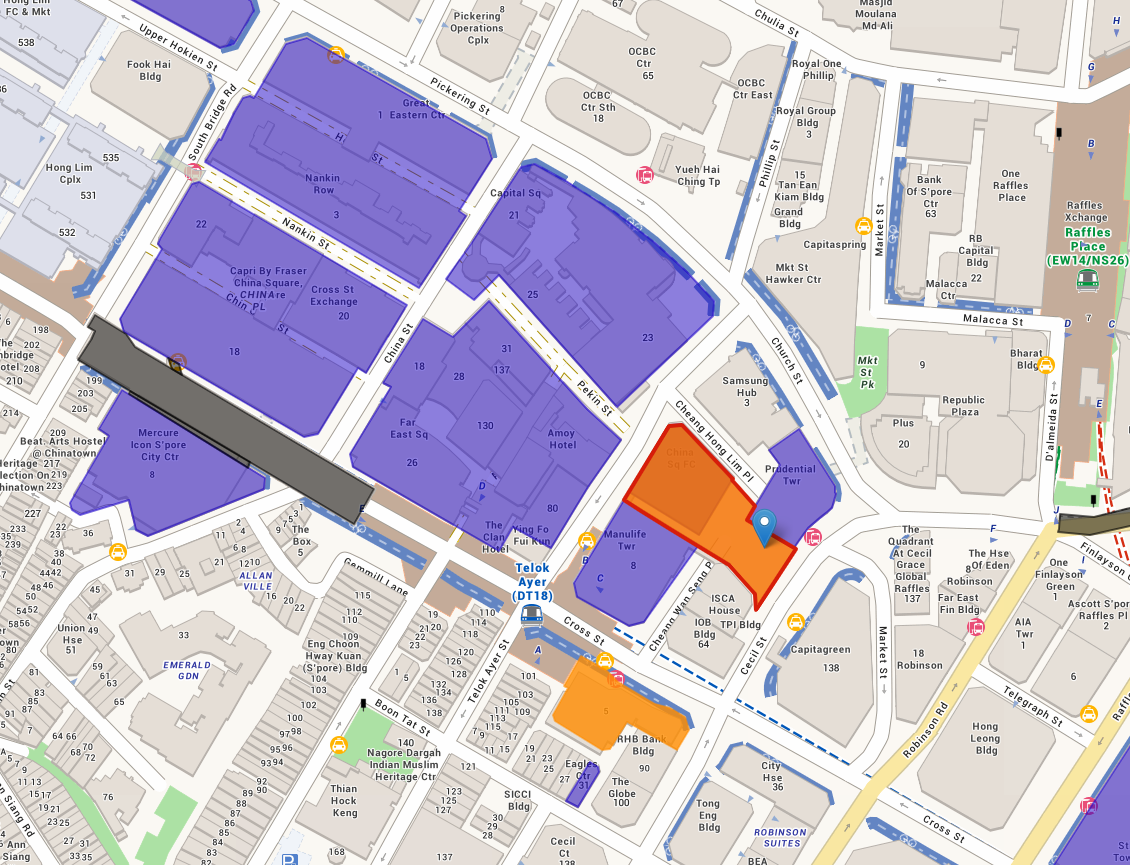

Cross Street - 300 units | *New Site

|

Telok Ayer Street - 200 units | *New Site

|

Source: PropNex Research, URA Space

Suggested Reads

Upcoming Events

View moreYou may like

Sustained private housing supply planned for 2H 2025 with several prime plots; total supply in 2025 highest since 2014

June 13, 2025

New Private Home Sales Fell By 9% In April From March On US Tariffs Concerns And Dearth Of OCR Launches; The City Fringe Led Sales - Spurred By Marina South Project

May 15, 2025

Propnex To Launch The Tender For The Sale Of Two Freehold Terrace Houses In Devonshire Road For A Guide Price Of $14 Million

May 14, 2025

Private Home Prices And Hdb Resale Prices Rose At A Slower Pace In Q1 2025; Us Tariffs And Us-china Trade Tensions May Cloud Sentiment

April 25, 2025